In a significant transformation of digital tax administration, the Federal Inland Revenue Service (FIRS) has commenced an electronic invoicing solution (e-invoicing) aimed at revolutionizing tax payment in the country.

The e-invoicing system, also known as the Merchant-Buyer Solution (MBS), aims to make tax compliance easier, faster and more transparent for all categories of taxpayers.

The e-invoicing solution went live on August 1 2025, following a successful pilot phase which began in November 2024.

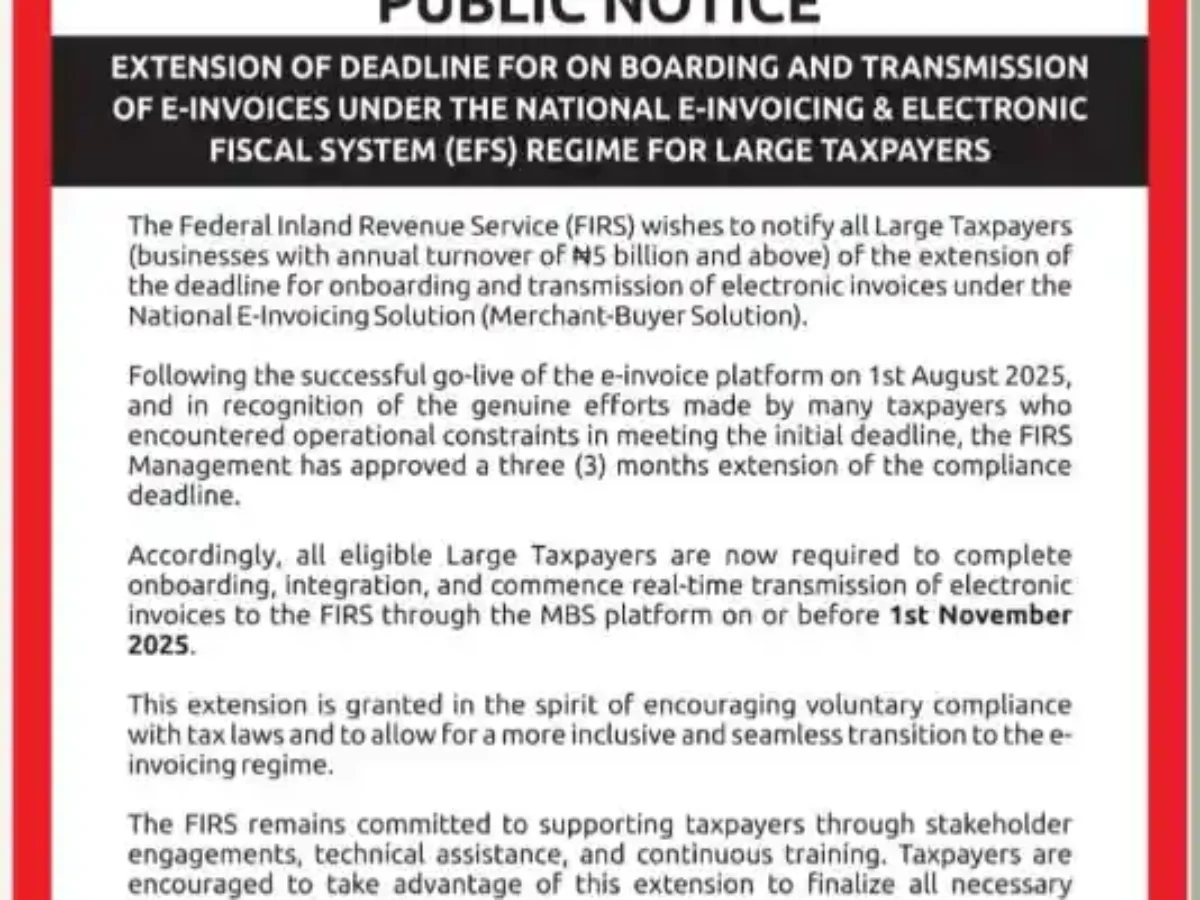

Large taxpayers, companies with annual turnover of N5billion and more, are expected to be the first to be on boarded on the platform.

In less than two weeks of the initiative going live, 1,000 companies, representing 20% of the 5,000 eligible firms, embraced the solution and commenced integration with the FIRS MBS platform.

The remaining large taxpayers are expected to come onboard on or before November 1, 2025 the deadline for all the firms in the category to finalize their on boarding and integration processes.

WHAT IS E-INVOICING

It is simply an automated process of validating business transactions with Government.

E-INVOICING PROCESS

Once an invoice is issued by the business, the accounting system (ERP) automatically sends the key details to the FIRS central platform, FIRS system instantly validates the invoice and sends back a unique authentication code.

This invoice with unique authentication code (invoice reference or authentication number) becomes the final invoice sent to customer.

Note that invoice without FIRS authentication code is not valid for tax purpose.

STEPS FOR BUSINESSES TO KEY INTO THE SCHEME

- ENABLE YOUR BUSINESS FOR E-INVOICING ON FIRS PLATFORM

- INTEGRATE BUSINESS ERP WITH FIRS E-INVOCING PLATFORM

- ENSURE INVOICES ARE ISSUED IN THE ISSUED IN THE REQUIRED STRUCTURE FORMAT.

- MAINTAIN COMMUNICATION WITH FIRS FOR GUIDANCE AND UPDATES

In a significant transformation of digital tax administration, the Federal Inland Revenue Service (FIRS) has commenced an electronic invoicing solution (e-invoicing) aimed at revolutionizing tax payment in the country.

The e-invoicing system, also known as the Merchant-Buyer Solution (MBS), aims to make tax compliance easier, faster and more transparent for all categories of taxpayers.

The e-invoicing solution went live on August 1 2025, following a successful pilot phase which began in November 2024.

Large taxpayers, companies with annual turnover of N5billion and more, are expected to be the first to be onboarded on the platform.

In less than two weeks of the initiative going live, 1,000 companies, representing 20% of the 5,000 eligible firms, embraced the solution and commenced integration with the FIRS MBS platform.

The remaining large taxpayers are expected to come onboard on or before November 1, 2025 the deadline for all the firms in the category to finalize their on boarding and integration processes.

WHAT IS E-INVOICING

It is simply an automated process of validating business transactions with Government.

E-INVOICING PROCESS

Once an invoice is issued by the business, the accounting system (ERP) automatically sends the key details to the FIRS central platform, FIRS system instantly validates the invoice and sends back a unique authentication code.

This invoice with unique authentication code (invoice reference or authentication number) becomes the final invoice sent to customer.

Note that invoice without FIRS authentication code is not valid for tax purpose.

STEPS FOR BUSINESSES TO KEY INTO THE SCHEME

- ENABLE YOUR BUSINESS FOR E-INVOICING ON FIRS PLATFORM

- INTEGRATE BUSINESS ERP WITH FIRS E-INVOCING PLATFORM

- ENSURE INVOICES ARE ISSUED IN THE ISSUED IN THE REQUIRED STRUCTURE FORMAT.

- MAINTAIN COMMUNICATION WITH FIRS FOR GUIDANCE AND UPDATES