Impact of PAYE Tax on You

Clarity is required on the frequently asked questions and the anxiety citizens are having on the impact on the Pay as You Earn tax on their earnings.

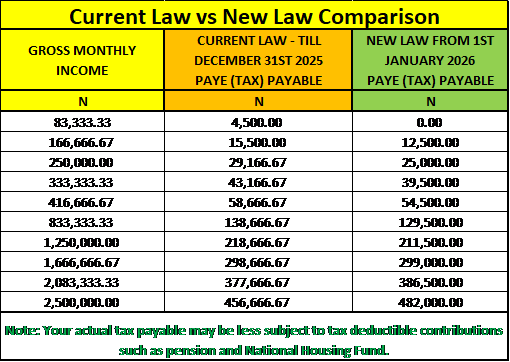

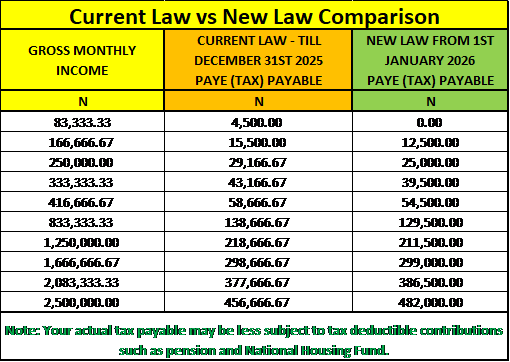

New tax reform symbolize progressive tax system on PAYE application, individuals earning N83, 333.33 per month will not pay any PAYE on the salary while monthly earnings above will pay more as the amount increases.

On Comparison, New PAYE calculation takes less tax from monthly earnings up to N1, 500,000.00 compare to the existing calculation. Monthly earnings above N1,500.000.00 per month will pay more on new rules compared to existing rules. The ceiling is 25%. The act also, increases tax exemption threshold for compensation for loss of employment or injury from N10m to N50m.

PAYEE COMPARISON (EXISTING & NEW)

REASONS FOR TAX REFORM

So many reasons are officially rolled out and defended with different classes of stakeholders and authorities in their chambers, communities and in open fora.

Some of the reasons are highlighted below.

Many Agencies performing same Functions

Multiple taxes are imposed on the same income by different agencies

OUTDATED TAX LAWS

Laws are not in tune with new business realities

FRAGMENTED LAWS

NEED to consolidate all tax laws in one document

EMERGENCE OF DIVERSE BUSINESS MODELS

There are emerging business arrangements and industries

HIGH RATE OF TAX EVASION

Need to collect accurate taxes

POOR TECHNOLOGY USE IN TAX MATTERS

No standard technology platform for use in compliance

EASE OF DOING BUSINESS

Nigerian businesses are facing unfavorable business environment

FISCAL FEDERATION

Revenue is not allocated to reflect fiscal planning at all government agencies

KEY TAX REFORM CHANGES

TAX HARMONIZATION

Single Window for All Taxes.

RIGHT TAX CALCULATION

Right tax calculation by aggregating income with expenditure and eliminate tax on capital

DIGITALIZATION

Introduction of E-Invoicing System, VAT Automation and other e-systems.

TRANSPARENCY

Corporate Governance on Tax Agencies, Reporting and Collections.

STRUCTURAL CHANGES

Elimination of Tax Evasion, Introduction of Progressive Taxes, Tax Ombud, Complementary Forex Measures.

GLOBALIZATION

Taxation on Non Resident Companies

VAT REFORM

Eligibility to claim input VAT on assets and services. VAT refund system.

0% COMPANY INCOME TAX

0% CIT for small and medium size companies.

TAX AGENTS

Every Company shall designate a representative(s) to attend to its tax matters provided that a paid agent shall be accredited