CONTENTS:

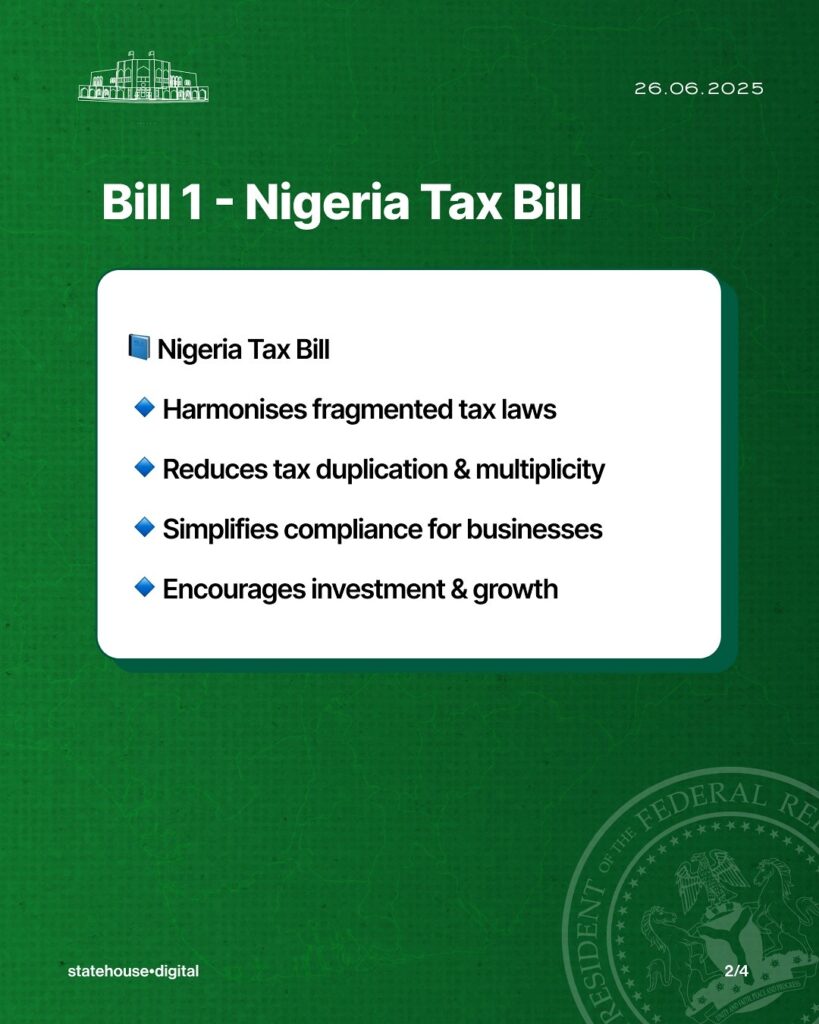

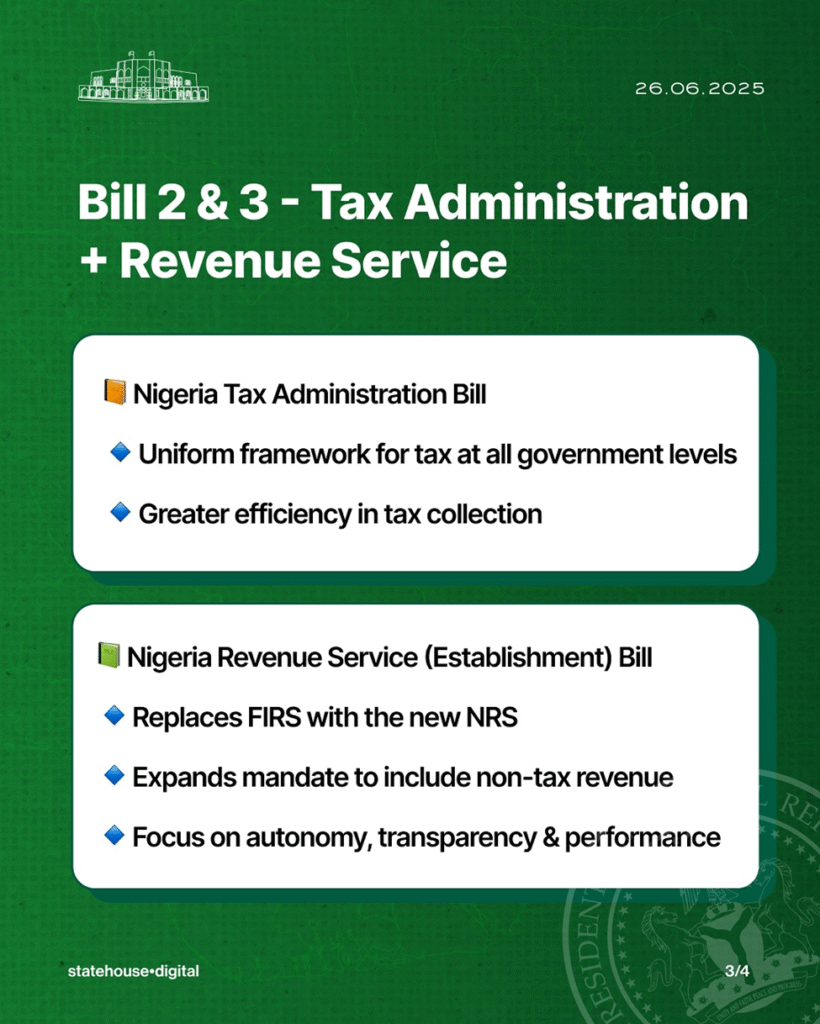

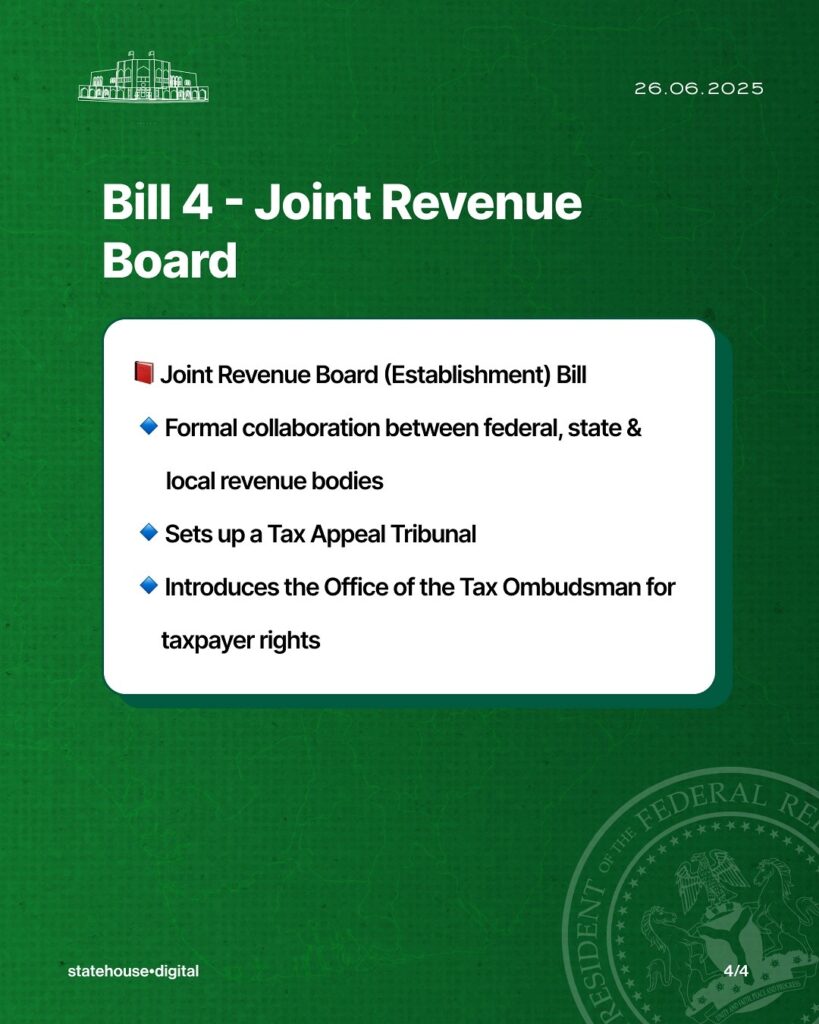

- Details of 4 Bills Signed.

- Impact of PAYE Tax on You

- Reasons for Tax Reforms

- Key Tax Reforms Changes

- New Applications and Interpretations

- Benefits of Tax Reforms

- What Individuals, Businesses and companies needs to do before 2026.

The Nigeria Tax Reform Act repeals certain existing tax laws and consolidates the legal framework governing taxation in the country into a single legislation for simplicity and improved tax administration.

Merging tax provisions into one single document will assist in eliminating overlapping, conflicting or ambiguous provisions that has been resulting in unnecessary complexity and uncertainty.

It helps to provide a clear and comprehensive view of tax laws in the country and enhance transparency and objective of the Act is to streamline Nigeria’s tax system by reducing the number of taxes to a manageable single-digit figure, also, reform is aimed at enhancing revenue generation, simplifying compliance procedures, and addressing regional disparities in tax administration.