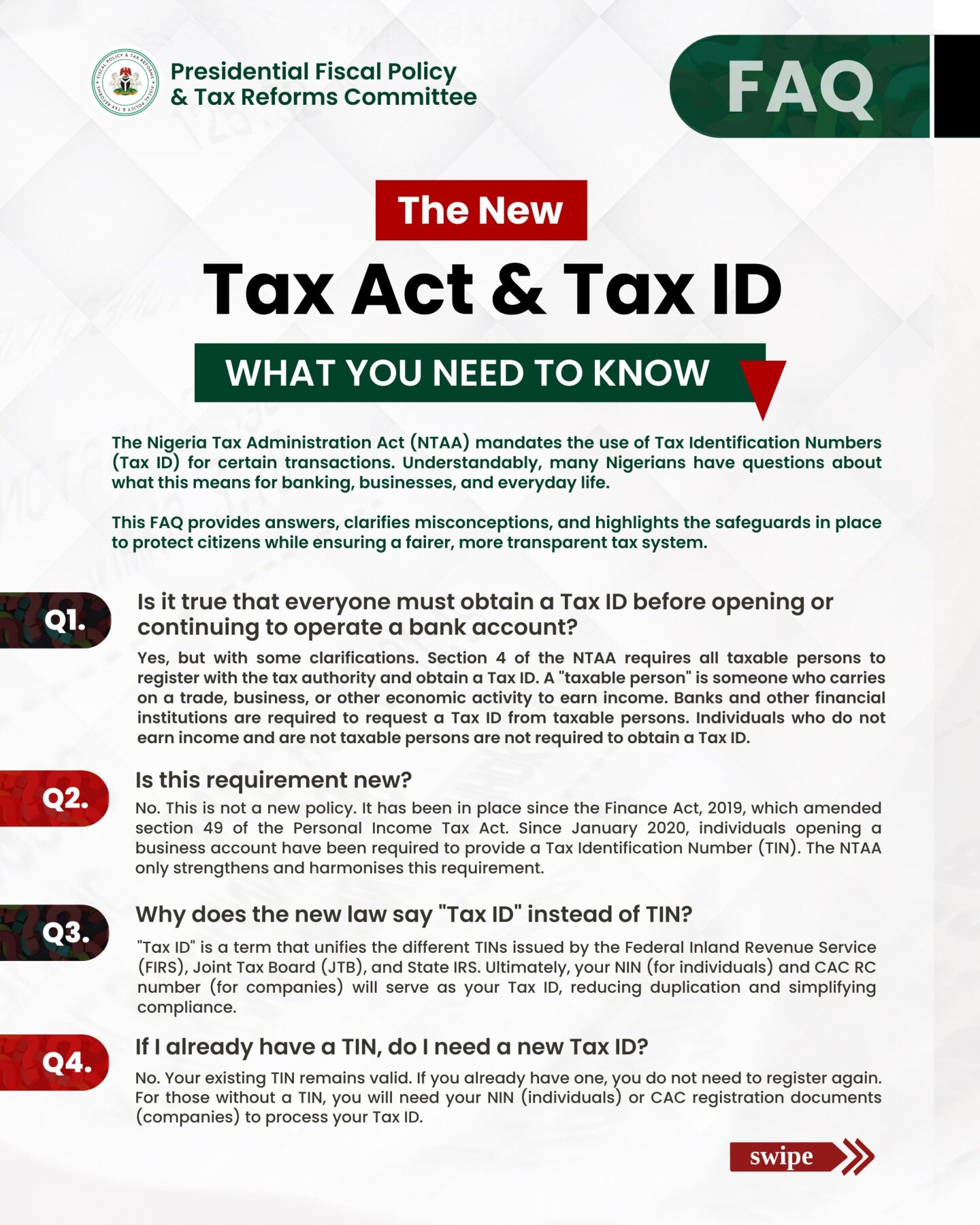

The Nigeria Tax Administration Act (NTAA) mandates the use of Tax Identification Numbers (Tax ID) for certain transactions. Understandably, many Nigerians have questions about what this means for banking, businesses, and everyday life.

This FAQ provides answers, clarifies misconceptions, and highlights the safeguards in place to protect citizens while ensuring a fairer, more transparent tax system.

𝐅𝐫𝐞𝐪𝐮𝐞𝐧𝐭𝐥𝐲 𝐀𝐬𝐤𝐞𝐝 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬

𝑸1. 𝑰𝒔 𝒊𝒕 𝒕𝒓𝒖𝒆 𝒕𝒉𝒂𝒕 𝒆𝒗𝒆𝒓𝒚𝒐𝒏𝒆 𝒎𝒖𝒔𝒕 𝒐𝒃𝒕𝒂𝒊𝒏 𝒂 𝑻𝒂𝒙 𝑰𝑫 𝒃𝒆𝒇𝒐𝒓𝒆 𝒐𝒑𝒆𝒏𝒊𝒏𝒈 𝒐𝒓 𝒄𝒐𝒏𝒕𝒊𝒏𝒖𝒊𝒏𝒈 𝒕𝒐 𝒐𝒑𝒆𝒓𝒂𝒕𝒆 𝒂 𝒃𝒂𝒏𝒌 𝒂𝒄𝒄𝒐𝒖𝒏𝒕?

A1. Yes, but with some clarifications. Section 4 of the NTAA requires all taxable persons to register with the tax authority and obtain a Tax ID. A “taxable person” is someone who carries on trade, business, or other economic activity to earn income. Banks and other financial institutions are required to request a Tax ID from taxable persons. Individuals who do not earn income and are not taxable persons are not required to obtain a Tax ID.

𝑸2. 𝑰𝒔 𝒕𝒉𝒊𝒔 𝒓𝒆𝒒𝒖𝒊𝒓𝒆𝒎𝒆𝒏𝒕 𝒏𝒆𝒘?

A2. No. This is not a new policy. It has been in place since the Finance Act, 2019, which amended section 49 of the Personal Income Tax Act. Since January 2020, individuals opening a business account have been required to provide a Tax Identification Number (TIN). The NTAA only strengthens and harmonizes this requirement.